Property data firm Cotality has released its latest research on Australia’s housing market, reporting the strongest calendar-year gain in home values since 2021.

In the last calendar year, the Home Value Index jumped 8.6%, adding approximately $71,400 to the national median dwelling value.

🏡 What’s growing?

According to Cotality’s research director, Tim Lawless, across every capital city the value of lower and middle-priced dwellings is growing around five-and-a-half times faster than higher-end properties, as affordability and serviceability pressures push demand towards cheaper homes.

🦘 Across the nation

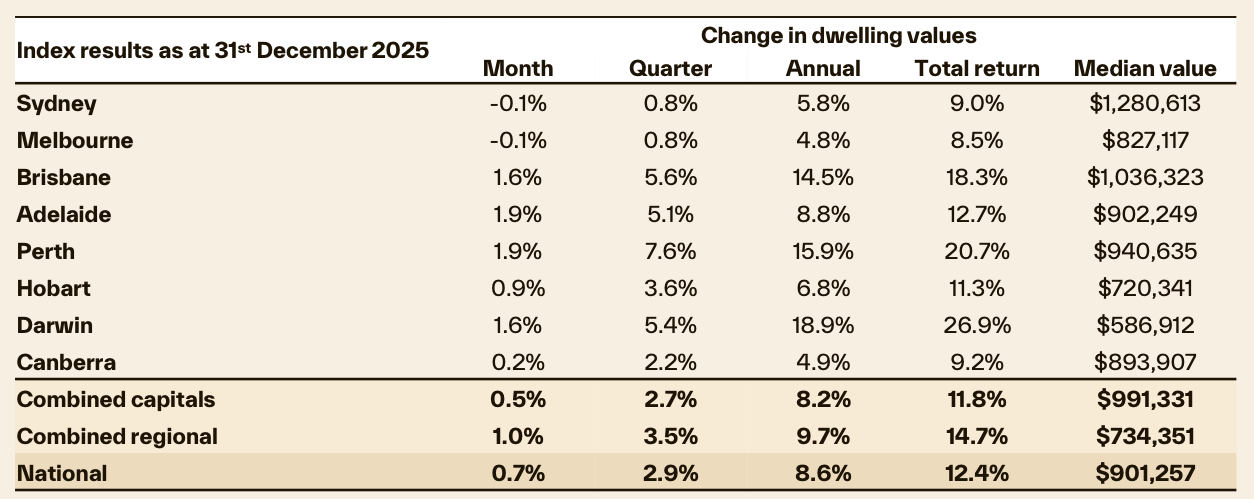

Darwin, Perth and Brisbane all saw the biggest value increases, jumping 18.9%, 15.9% and 14.5% respectively.

Source: Cotality

💰Rents

Across the country, the rental vacancy rate rose by just 0.1% percent in December, with that total figure now sitting at 1.6%. Meanwhile, rent prices have risen 5.2%.

Lawless said it’s difficult to get a clear picture of the rental market in December and January, with leasing cycles disrupted by university breaks and the festive season.

“We will get a better feel for rental conditions in February,” said Lawless. “However, even if conditions have loosened a little, it's from an extremely tight position, and rents are likely to rise further through 2026.”

🤑 Profits

Rents are still rising, but home prices are rising faster, which is pushing rental profits down.

Nationally, gross rental profits fell in 2025, dropping from 3.67% to 3.56% of a property's value, the lowest level since September 2022.

Sydney has the lowest rental yields of any capital city, at around 3.0%, slightly down from last year.

Darwin has the highest yields at 6.19%, but even then profits have fallen as property prices have risen faster than rents.